13.08.2025 01:47

Do Kwon, the co-founder of the defunct Terraform Labs, is set to admit guilt on charges of conspiracy and wire fraud in a U.S. federal court, relating to the catastrophic collapse of the TerraUSD stablecoin. This significant development follows months of legal proceedings and marks a major turning point in the case surrounding the approximately $40 billion loss incurred by investors.

Prosecutors contend that Kwon deliberately misled investors, falsely portraying the efficacy of the "Terra Protocol" algorithm in maintaining TerraUSD's $1 peg. Their claims detail a clandestine operation involving a high-frequency trading firm, secretly purchasing substantial quantities of TerraUSD to artificially prop up its price during a period of market instability in May 2021. This deceptive strategy, according to the prosecution, fuelled further investment and ultimately contributed to Luna's soaring market capitalization, peaking at around $50 billion before the subsequent devastating crash.

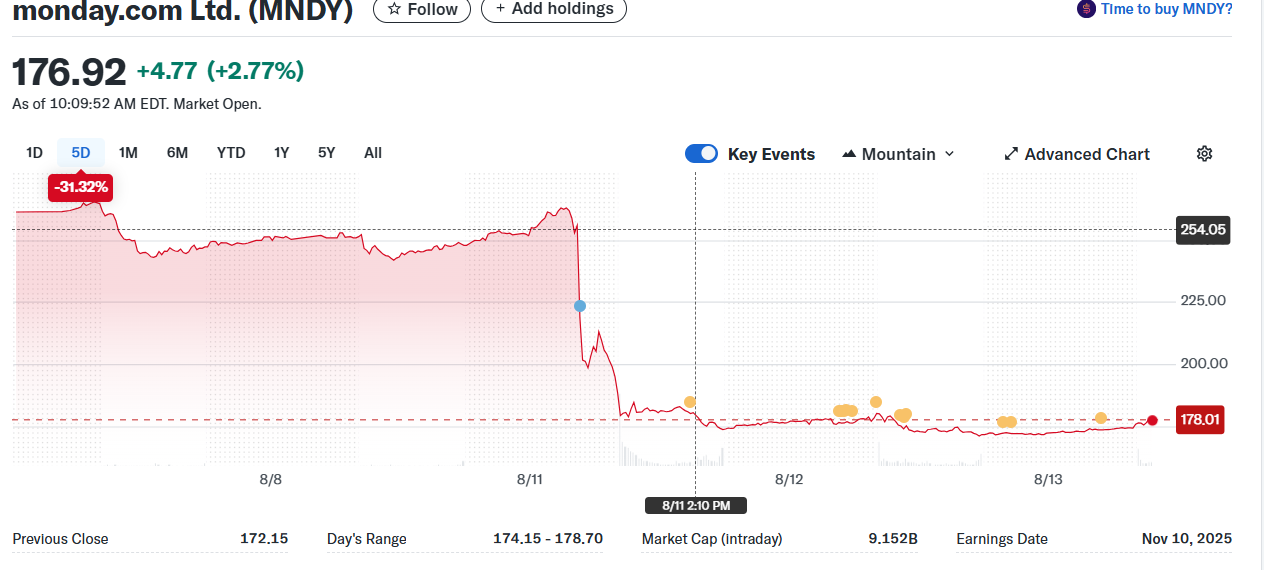

This guilty plea, confirmed by U.S. District Judge Paul Engelmayer during an August 12th hearing, represents a reversal of Kwon's previous not-guilty plea entered in January. The 33-year-old entrepreneur will now face the consequences of his actions, a stark contrast to his initial defense against the nine-count indictment. This outcome was widely anticipated, aligning with earlier predictions from various sources.

The criminal proceedings are distinct from a parallel civil suit filed by the U.S. Securities and Exchange Commission (SEC). In a separate settlement reached in 2024, Kwon and Terraform Labs agreed to pay a staggering $4.55 billion in penalties and accepted a lifetime ban from engaging in any cryptocurrency transactions. The SEC’s case focused on allegations of misleading statements made by Terraform Labs and Kwon, adding another layer of accountability to his actions.