11.08.2025 08:08

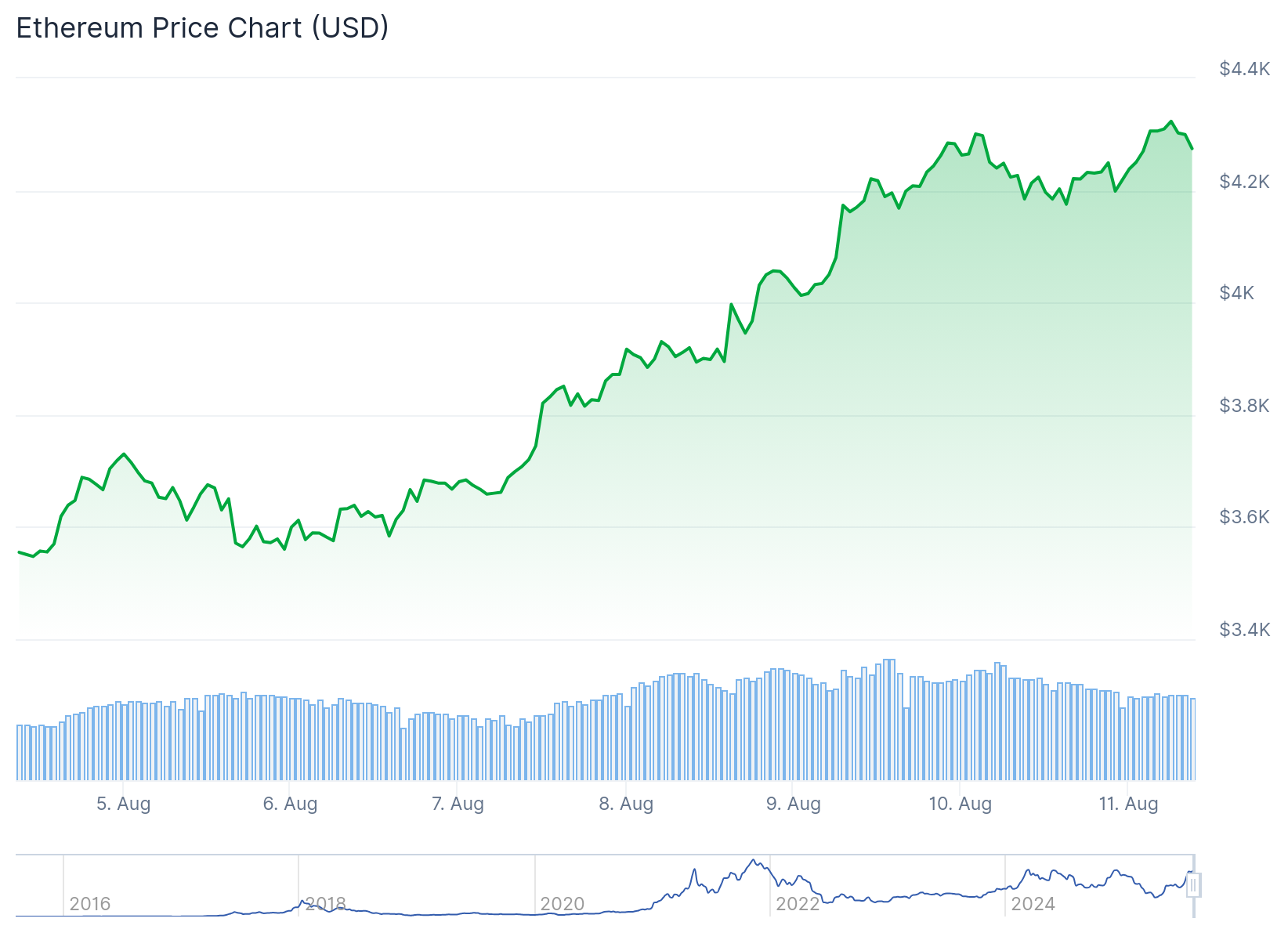

Ethereum (ETH) experienced a phenomenal surge, exceeding $4,300, fueled by record-breaking ETF inflows and significant institutional investment. A single day witnessed a staggering $461 million poured into Ethereum ETFs, dwarfing Bitcoin's $404 million inflow. This impressive influx represents a significant shift in market sentiment and investment strategies.

BlackRock spearheaded this institutional buying spree, contributing a substantial $250 million to ETH purchases. Close behind were Fidelity, investing $130 million, and Grayscale, adding another $60 million. This coordinated influx of capital from major players underscores the growing confidence in Ethereum's future and its potential for significant returns.

The impact on ETH's price was immediate and dramatic. A weekly increase of 25% far outstripped Bitcoin's more modest 5.4% gain, highlighting Ethereum's exceptional performance. This price jump reflects the market's positive response to both the ETF inflows and the substantial institutional backing.

Further evidence of market excitement comes from the derivatives market, where open interest in futures contracts is climbing rapidly. This heightened activity indicates significant investor engagement and anticipation of continued price volatility, suggesting a bullish outlook for Ethereum in the near future. Increased speculation and active trading reinforce the strong sentiment surrounding the cryptocurrency.