18.07.2025 16:50

BlackRock, a prominent asset management firm, has submitted an application to integrate staking functionality into its already successful Ethereum exchange-traded fund (ETF). This significant development allows investors to earn passive income from their holdings, significantly enhancing the ETF's appeal and competitiveness beyond simple price exposure to Ethereum (ETH).

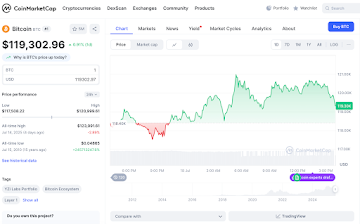

The positive market response to this news is evident in Ethereum's price surge, currently nearing the $3,500 mark. This upward trend is directly attributable to the increased attractiveness of ETH investment, fueled by the passive income opportunities stemming from the proof-of-stake (PoS) consensus mechanism. Staking, which involves locking ETH tokens to secure the network, now offers lucrative rewards to holders.

Previously, regulatory hurdles prevented the inclusion of staking in Ethereum ETFs, primarily due to concerns that staking agreements might be classified as investment contracts. However, the recent shift towards a more crypto-friendly stance by the Securities and Exchange Commission (SEC) has paved the way for this innovation.

BlackRock's move isn't isolated; other major players in the financial industry, including Fidelity, 21Shares, and Franklin Templeton, have also filed applications to incorporate staking into their respective Ethereum ETF offerings, indicating a broader industry trend towards embracing this lucrative feature for investors. This collective effort reflects a growing confidence in the future of Ethereum and the potential for passive income generation within the cryptocurrency market. Information compiled from various internet sources.