24.06.2025 06:58

Following four waves of Iranian attacks targeting Israeli-occupied territories, a ceasefire between Iran and Israel has officially commenced. This announcement, relayed by Reuters citing Iranian state media, brings a temporary halt to escalating tensions in the region.

President Donald Trump's confirmation of the truce on Tuesday urged both nations to maintain the agreement. Earlier that day, the Israel Defense Forces (IDF) reported intercepting missile launches originating from Iran aimed at southern Israel. The impetus for the ceasefire, according to Iranian Foreign Minister Abbas Araqchi (as reported by Reuters), was contingent on Israel ceasing its "illegal aggression" against Iranian citizens by 4 a.m. Tehran time (00.30 GMT). Iran explicitly stated it would not retaliate further should this condition be met.

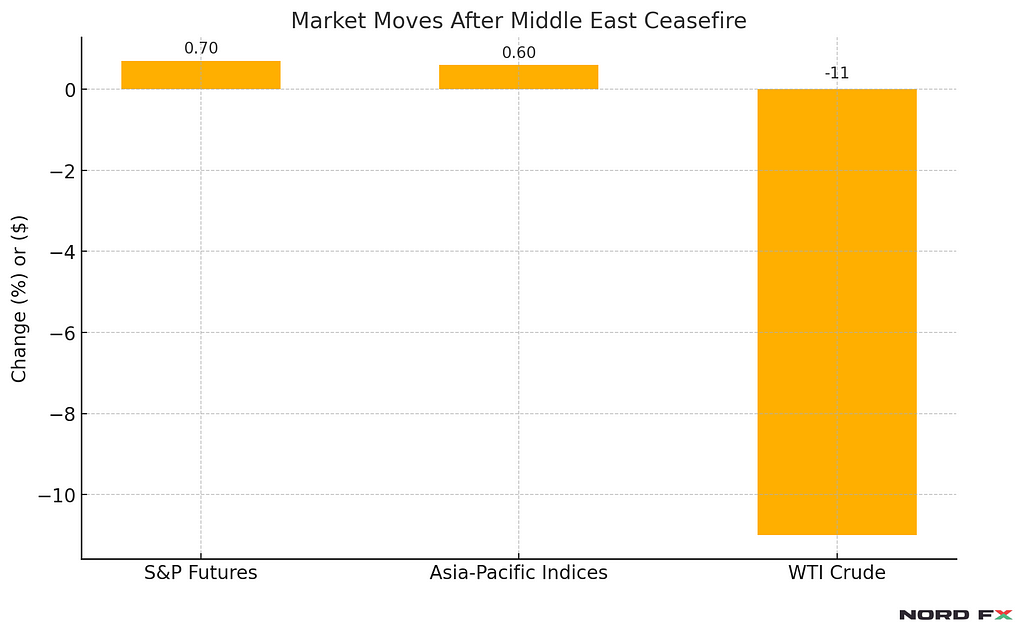

The global markets reacted to this geopolitical development. At the time of writing, West Texas Intermediate (WTI) crude oil prices experienced a 1.25% decline, settling at $66.15 per barrel. Similarly, gold (XAU/USD) saw a 0.62% drop, trading at $1,933.45 per ounce.

This situation underscores the concepts of "risk-on" and "risk-off" market sentiment. These terms describe investor appetite for risk. A "risk-on" environment reflects optimism, leading to investment in higher-risk, higher-reward assets like stocks and commodities (excluding gold). Conversely, a "risk-off" scenario, driven by uncertainty, prompts investors to favor safer assets such as bonds and gold, resulting in a flight to safety. The current events suggest a shift towards a "risk-off" environment, reflected in the decline of oil and gold prices. The interplay between geopolitical events and investor behavior highlights the intricate relationship between global affairs and financial markets.