24.06.2025 11:09

President Trump's unexpected announcement of a complete and total ceasefire between Israel and Iran brought an abrupt end to twelve days of intense conflict. His statement lauded both nations for their purported courage and strategic acumen in reaching this agreement.

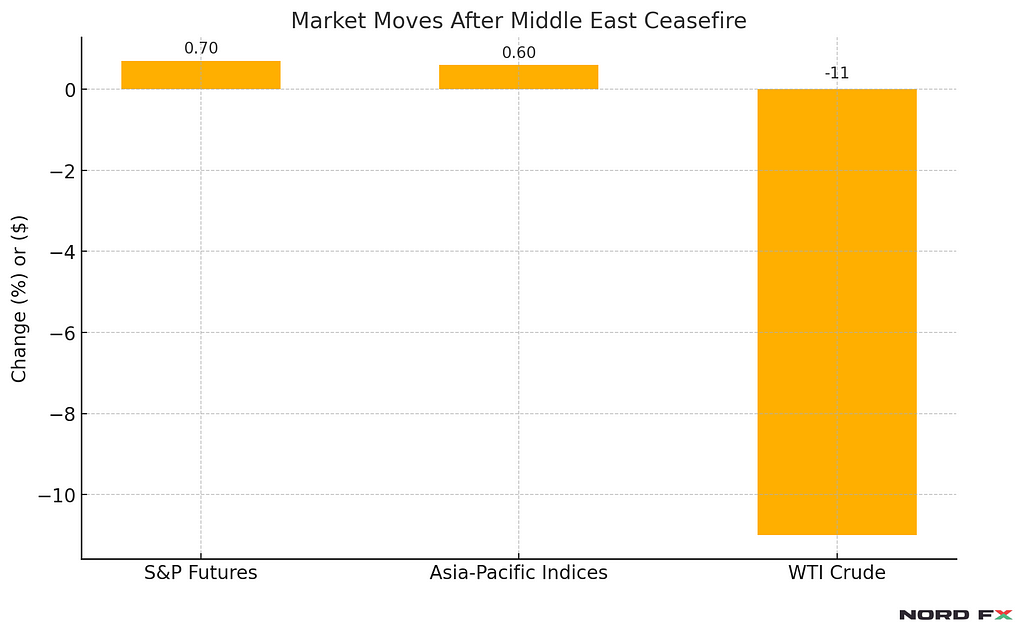

The news, breaking after the close of US markets on Monday, sent immediate ripples through global financial markets. S&P futures experienced a significant upward surge, while oil prices plummeted, reflecting a lessening of supply disruption fears.

This positive momentum continued into Tuesday's Asian trading, with Asia-Pacific indices climbing, and the US dollar and oil prices concurrently experiencing sharp declines as the Middle Eastern ceasefire held. A minor complication arose when Iran launched missile strikes shortly after the agreed-upon ceasefire time (04:00 GMT), technically violating the truce. However, despite this breach, global markets remained remarkably calm. Iranian media framed these missile strikes as a final act of defiance before the ceasefire's official commencement. Reports indicate that Israel ceased hostilities by 00:30 GMT, though Iran's retaliatory actions briefly continued thereafter.

West Texas Intermediate (WTI) crude oil prices saw a dramatic $11 drop, a clear reflection of the reduced anxiety surrounding potential supply chain interruptions. US stock indices are currently trading up between 0.50% and 0.80%, nearing record highs. The President's announcement played a crucial role in calming oil markets, and subsequent revelations suggest the US possessed prior intelligence regarding Iran's planned actions, hinting at a degree of coordination in the final attacks. The ceasefire agreement, according to the White House, hinges on Israel's cessation of hostilities contingent upon Iran's commitment to refrain from further escalation; both sides appear to be currently adhering to the truce.

Beyond the Middle East, positive economic news emerged from South Korea. June's consumer sentiment index reached its highest point since June 2021, at 108.7, while inflation expectations dropped to their lowest level since October 2021, settling at 2.4%. In a separate development, HSBC significantly revised its EUR/USD exchange rate forecast upward to 1.20 by the end of 2025, citing the accelerating trend of global de-dollarization.