15.08.2025 14:55

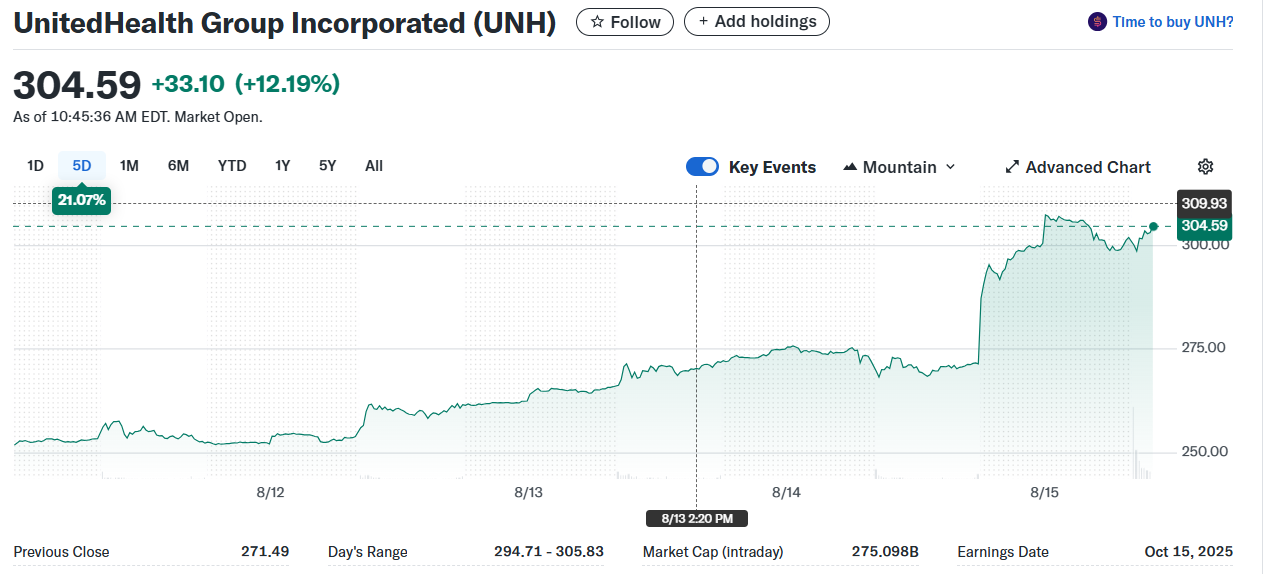

Berkshire Hathaway's significant investment in UnitedHealth Group sent shockwaves through the market Friday, propelling UNH shares to a remarkable 12% surge. This substantial $1.6 billion commitment represents a rare foray into the healthcare sector for Warren Buffett, particularly striking given UnitedHealth's recent operational headwinds and the broader market's instability.

The bold move underscores a shift in Berkshire Hathaway's investment strategy. Simultaneously, the company trimmed its substantial Apple holding by a considerable 20 million shares, demonstrating a clear effort to diversify its vast portfolio. This strategic reallocation of assets highlights a calculated risk-mitigation approach by Buffett's investment team.

Further cementing Berkshire's cautious stance, the company reported a staggering $344.1 billion in cash reserves. Maintaining a defensive posture for an unprecedented eleven consecutive quarters, Berkshire continues to prioritize capital preservation amidst economic uncertainty. This massive cash hoard underscores a strategy prioritizing stability and preparedness over aggressive growth. The impressive increase in UNH stock value starkly contrasts with the more conservative approach adopted elsewhere in their investment portfolio.